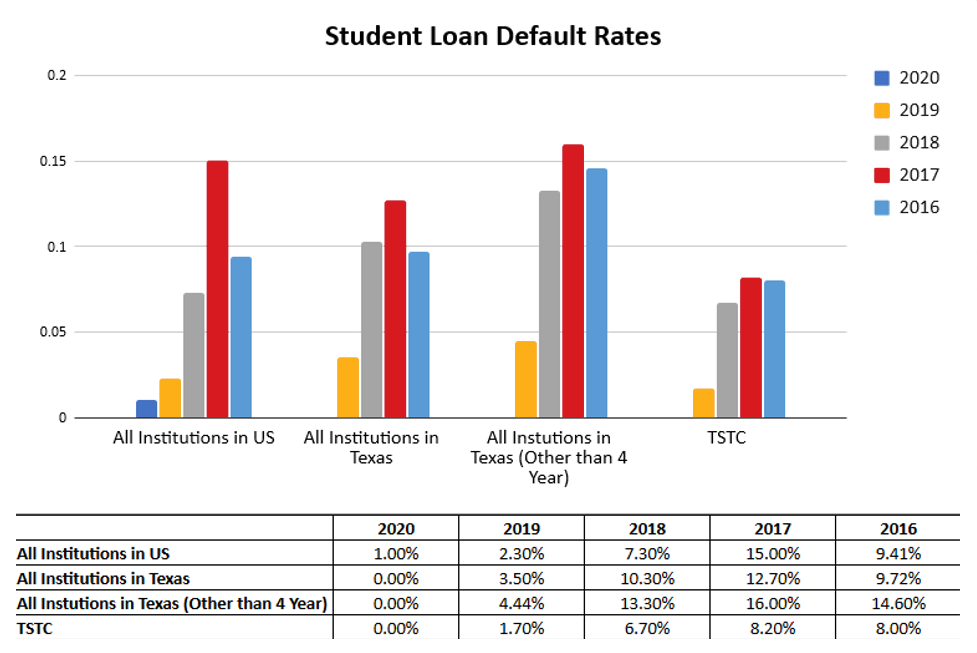

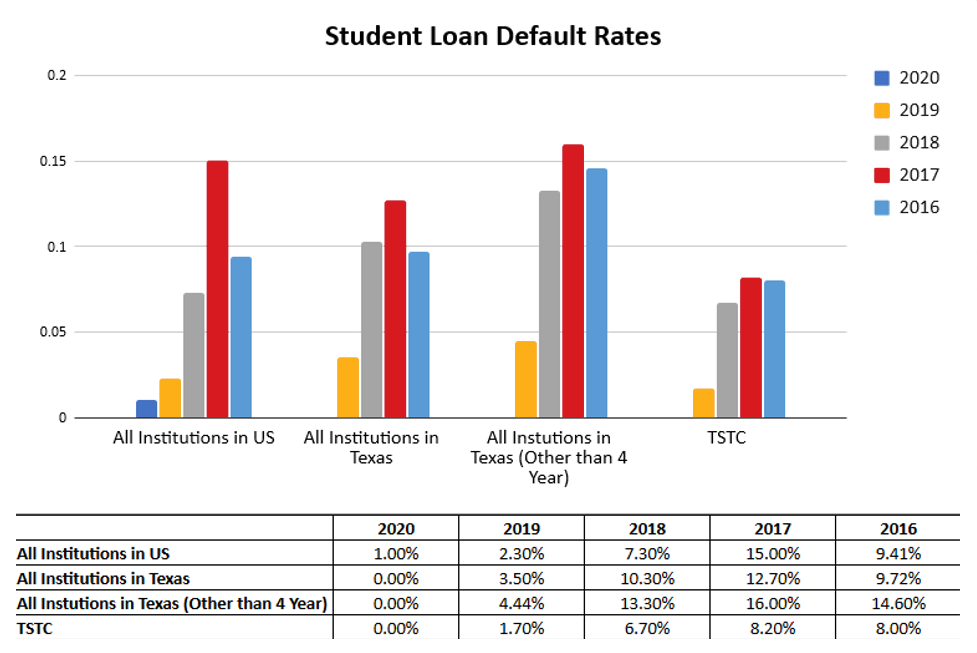

The FY 2020 default rates were calculated using the cohort of student loan borrowers who entered repayment on their William D. Ford Federal Direct Loans or Federal Family Education Loans (FFEL) between Oct. 1, 2019, and

Sept. 30, 2020, and who defaulted between Oct. 1, 2019, and Sept. 30, 2022.

As expected, FY 2020 cohort default rates were significantly impacted by the pause on federal student loan payments that began March 13, 2020. During the pause, borrowers with ED-held student loans were not required to make any payments, and no borrowers with ED-held loans entered default. Fewer than 200 borrowers with non-ED-held FFEL loans entered default because those loans were not eligible for the payment

pause.

Some schools have a small number of student loan borrowers entering repayment. At other schools, only a small portion of the student body takes out student loans. In such cases, the cohort default rate should be interpreted with caution.

From FY 2016 to FY 2019, TSTC’s rate dropped from 8% to 1.7%. The chart below shows how TSTC compares with other schools and that it is below the national average.

More information is available at Official Cohort Default Rates for Schools.